The upcoming FIFA World Cup 2022 in Qatar won’t just be the first held in the Arab world. It will also be the first taking place in the northern hemisphere’s winter, from November 21 to December 18.

For brands and their media agencies, this creates an unprecedented and unique situation, the coming-together of two otherwise distinct seasons - the global celebration of the world’s most popular sport and the increasingly-long festive holiday period that now incorporates Christmas, Hanukkah and Black Friday.

From a media, sponsorship and advertising perspective, individually, these are the two mostly predictable and easily-modelled moments in the calendar. However, they’ve never been wrapped up and presented in unison before. So, what will this overlap mean for brands and their agencies?

Winners and losers

The industry is acutely aware of the huge impact this collision will have for certain categories.

Certainly, grocers, alcohol and food categories are all perennial benefactors from each individual event. They could further benefit from the congruence effect and the amplified anticipation, jubilation and associated indulgence that would create.

There’s an argument for simply adapting creative or comms tactics for these categories, whilst sticking with time-honoured festive marketing strategies to optimise outcomes. A tweak to their typical media plan and “throw a footballer into the Christmas ad” may over-simplify the suggestion, but the brands in these categories definitely won’t need to rewrite the playbook entirely.

Alcohol brands may have to adapt more than most - limitations on brand presence within the stadiums suggest a redirect of those marketing pounds into above-the-line media or in-store presence.

Battle for consumer spending

But there is more potential conflict for those brands who rely on the pre-Christmas window.

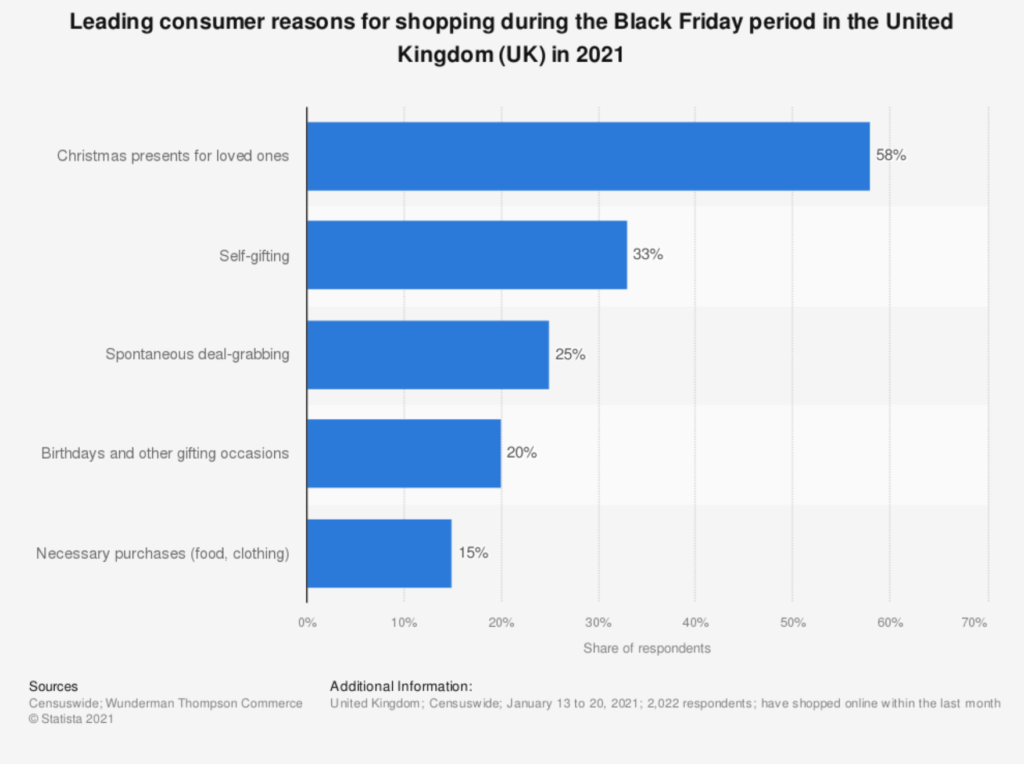

Gifting remains the biggest expenditure at this time, with consumer electronics, toys and clothing consistently the top three categories. But some consumers, feeling the cost-of-living pinch, may need to choose between buying gifts for loved ones or investing in their own enjoyment of the tournament.

A new 4K TV set bought "for the family" on Cyber Monday as an early festive gift may not cut it with the kids come Christmas morning. Who will the beneficiaries be?

The stay-at-home World Cup

Research undertaken prior to the 2018 FIFA World Cup found that audiences mostly stay at home:

- One in four Sun readers were planning to primarily watch the action in the pub.

- 60% said they would do so at home with friends and family.

- 38% said they would watch at home alone.

For this event, in place of summer sun and a beer garden, the World Cup will play out with the appeal of cosy home comforts and a dedicated family viewing experience. This might lessen on-trade business and bolster the off-trade sale of alcohol, whilst snacks and party foods should still benefit despite the HFSS ban on in-store promotions.

The rising cost of living will doubtless have an effect, too. With at least three fixtures involving each home nation, pub trips for high-cost drinks could be replaced by stay-at-home match-day parties with family or friends.

However, even without a Christmas World Cup, anything close to a "normal" festive season will now see pubs and bars achieve a level of demand and frequent capacity unseen for at least three years, before lockdown. The on-trade sector could conversely be a very conspicuous beneficiary from the action in Qatar, serving as a catalyst to tempt revellers back out the house.

All this suggests that alcohol marketers, in particular, will need to maximise their brands' presence and appeal in this unique moment to capitalise on the collective appetite - or, thirst - it generates.

Demand drives noise

Despite a prospective rise in festive audience numbers, it won’t be sufficient to match the exponential rise in demand for ratings.

There will be an inevitable and unavoidable impact due to the disparity between supply and demand. Accessing linear TV inventory may become challenging due to the combination of three factors:

- TV inflation (the cost dynamic of demand and availability applied to TV advertising).

- Tournament premiums (the additional cost for running against World Cup games).

- Traditional festive focus on share of voice for supermarkets and FMCG and alternative categories muscling in.

For brands with either official sponsorship status or the spending power pre-allocated to capitalise on the World Cup, the switch from summer to Christmas will be a natural amplifier for their comms plans, with more at-home viewing and engagement.

But there is a bigger challenge for brands vying for share of voice across the festive period, because the sudden influx of temporary-interest categories and brands will make for a cluttered and noisier environment.

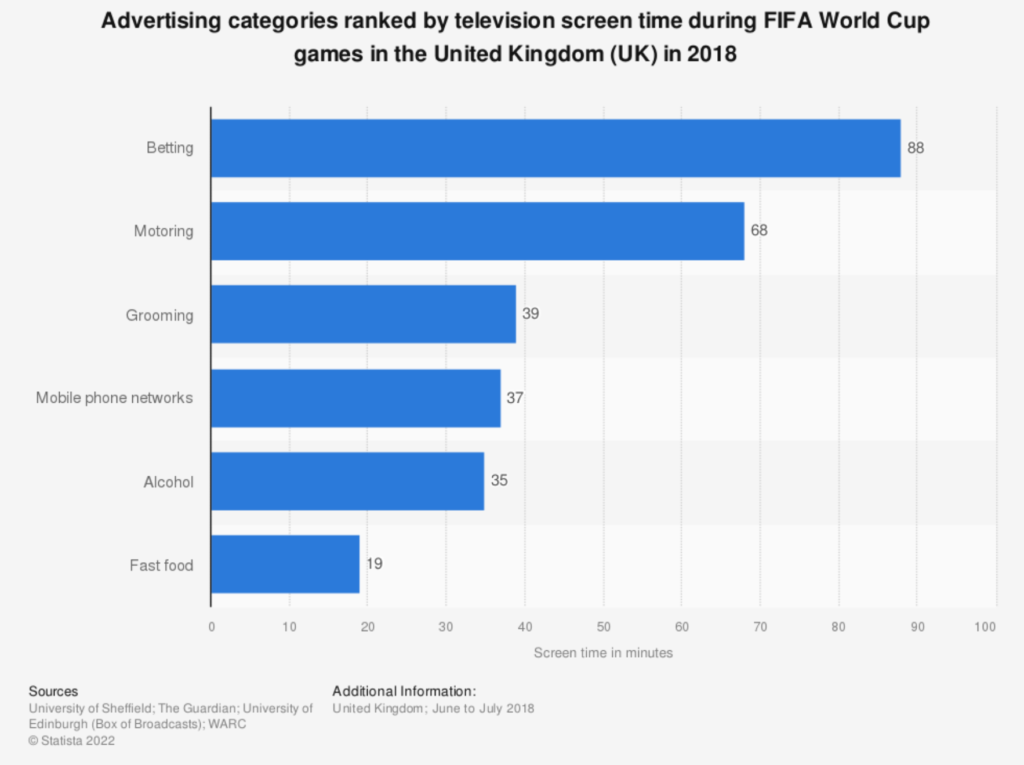

For example, where supermarkets were previously competing for TV ratings and cut-through against their category competitive set, now they will be pitching for time, space and attention against bookmakers, grooming, motors, mobiles and fast food - those categories that aim to capitalise on football fever.

Betting firms, in particular, fight a similar war for share of voice during tournaments as grocers do in the run-up to the holiday season, typically accounting for a fifth of in-game airtime. This season, it will be a clash of the spending titans - but money can’t buy more time or audiences in an environment of finite supply.

Men are particularly persuadable

So who are those alternative audiences?

Some 68% of men and 43% of women say they plan to watch Qatar 2022, according to a Morning Consult survey.

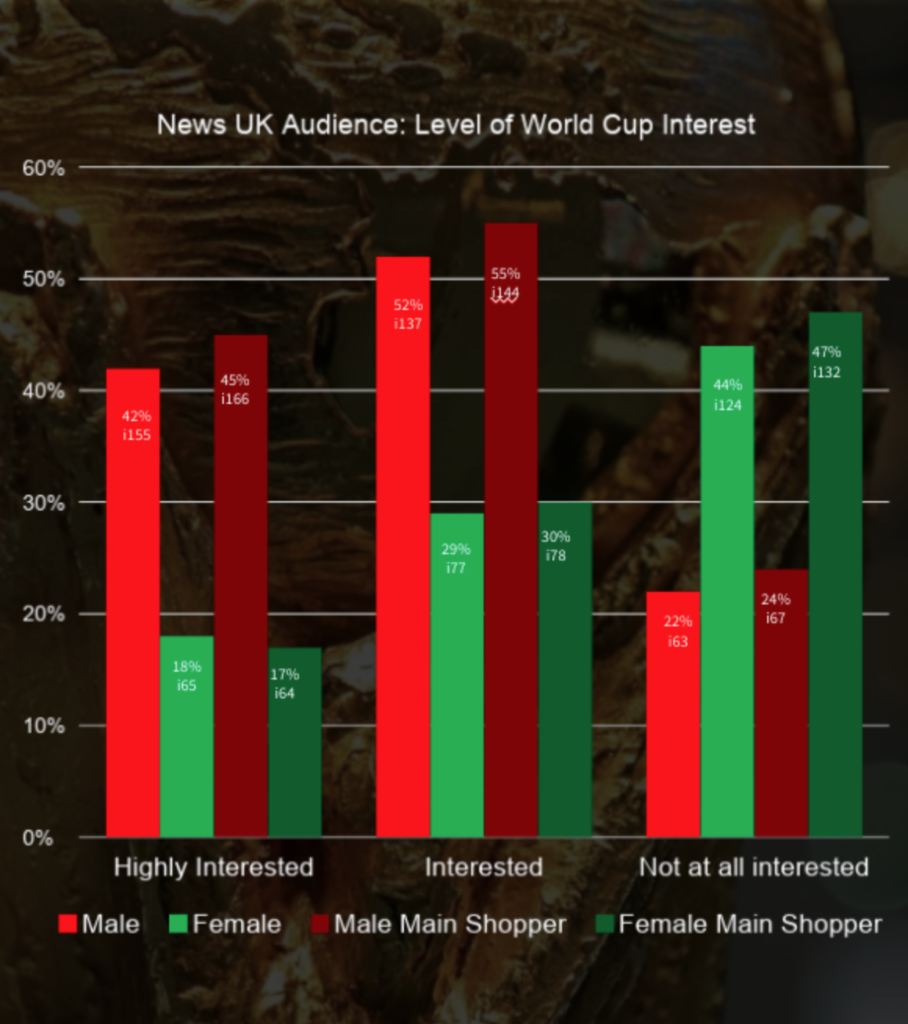

Using TGI GB data, we have also crunched the numbers on our own News UK audience footprint, with intriguing results.

Our men are almost twice as likely as women to be interested in the FIFA World Cup and more than twice as likely to be highly interested. But men who are the main household shoppers are even more likely to be interested than men overall. Call them the "Festive Footy Fellow Shoppers".

Why does this matter? While a major tournament doesn’t necessarily change who does the main household grocery shopping, it has a profound impact on household decision-making.

Women in our audiences are 22% more likely to be main shoppers. But research from previous World Cups, as well as sporting events more generally, indicates contextually-placed and tactical advertising or sponsorships are far more effective at persuading men at this time, irrespective of their level of interest.

In short, for those men with shopping responsibilities, the World Cup holds even more importance and interest; they are even more open to messages that influence their choices. Perhaps a festive-season football tournament could influence them to make changes to their seasonal shopping baskets.

Women will lean-in

However, consider that the majority of Christmas food shopping in UK multi-person households is undertaken by females - 54% versus 13%, according to YouGov.

Our research found just 3% more News UK men will take an interest in the World Cup than those who typically follow football.

But, for women, some 25% more will follow the tournament than typical football, a significant up-tick.

What we actually have, then, is a coming-together of two decision-making pulse points and profiles.

Toward incremental reach

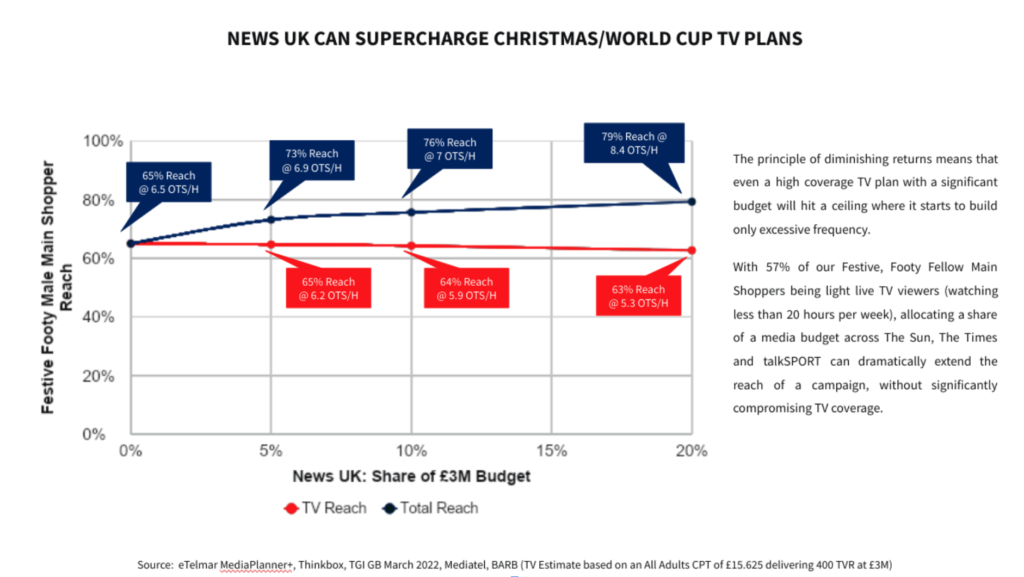

In this busy seasonal environment, even a high-coverage TV plan with a significant budget could hit a ceiling, where it starts to build only excess frequency.

In this busy seasonal environment, even a high-coverage TV plan with a significant budget could hit a ceiling, where it starts to build only excess frequency.

In that scenario, what marketers need is to find incremental reach. This isn’t a new concept.

What is fresh is the prospect of doing so via newly-identified consumer segment. Some 57% of our "Festive Footy Fellow Shoppers" (football-interested male audiences who are the main household shopper) are light live TV viewers, watching less than 20 hours per week.

So, reallocating of a share of AV media budget across The Sun, The Times and talkSPORT would dramatically extend the reach of a campaign, without significantly compromising planned TV coverage.

All in all, for advertisers that plan effectively for the winter World Cup spectacular, by using a broader channel approach and embracing the right audience, the coming season could be a win-win.

News UK

News UK