Which brands are audiences loyal to in 2022, and what factors shape that loyalty?

New research from Times readers and listeners shows how value brands are joining traditional mainstays in shoppers’ affections - and how advertising environment, sustainability and durability shape perceptions of brand quality.

News UK commissioned a two-stage study into a large emerging audience for The Times’ cross-platform properties, one discovered in its earlier A Point In Time research - namely, ABC1 25-44s.

Open to change

The new research, Trends & Traits, which is being presented to ad agency planners, paints a picture of a modern group of open-minded, caring and ambitious consumers:

- 72% say they are open to change.

- 74% are driven by looking out for others.

- 71% rank self-enhancement, closely linked with authority and wealth, as a guiding value.

The group is open-minded:

- 75% say they take risks in everyday life.

- 64% are high extroverts, comfortable voicing their own opinions and more likely to be curious, able to participate in adventure.

- 60% are open to new experiences.

The rise of value

These traits have a direct impact on the new audience’s brand choices.

When asked which brands they are loyal to, well-respected product innovators like Apple, Nike, Google and Tesla, predictably, were cited.

But a noteworthy observation is that, for this new Times audience, a number of everyday and lower-price brands are also starting to make an appearance - brands like Zara, H&M, Asos and Aldi.

Open to trialling new brands, many study participants said they had tried high-end names like Balenciaga, Gucci, Chanel and Louis Vuitton in the last year, but also high-street brands like Ikea, Disney, Next, H&M and TK Maxx.

How quality is created

This adds up to a willingness to experiment - at least, where a brand is deemed to offer a quality deal. Study participants described what earns their loyalty:

- 50% said quality of products or services.

- 45% said good value.

- 36% said sustainability.

- 36% also said ethical products and services.

So, what exactly shapes a perception of the biggest loyalty driver, “quality”? Interestingly, participants said brands’ advertising itself is the biggest single factor defining brand quality:

- Taken together, advertising-related factors (well-designed ads and a trustworthy media environment) made up 46% of the top three factors which participants rated the most important contributors to quality.

- Sustainability of materials and values were 35% of the top three.

- Durability comprised 19% of the top three.

Specifically, it is the content driving that perception of context. Seventy-three percent of participants said the quality of journalism surrounding advertising positively impacts the perception of a brand ad.

Times’ multimedia contexts

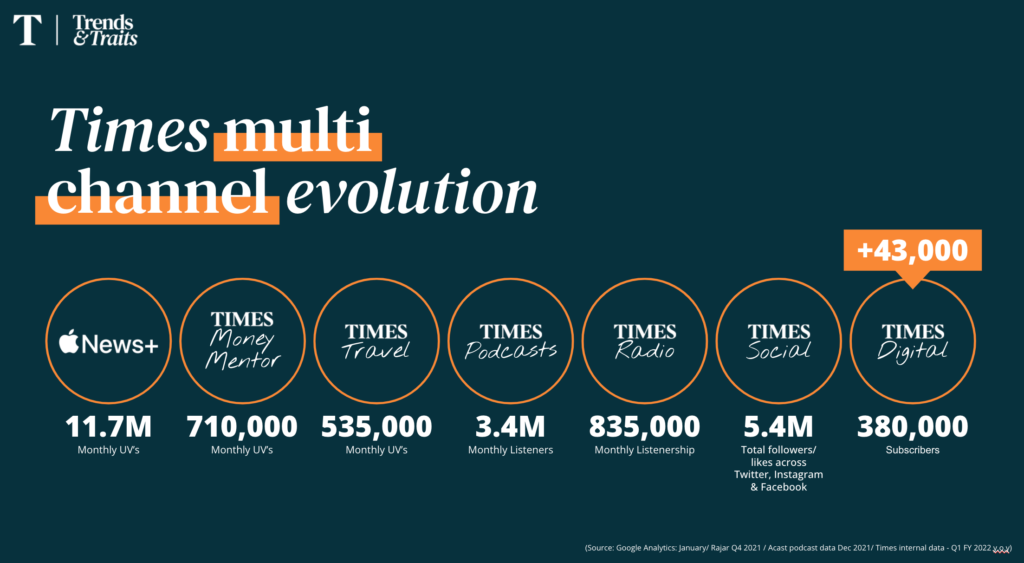

The Times’ modern portfolio is one employing multi-channel breadth to grow both its subscription customer base and its ad-exposed audience.

Digitally, The Times now claims 13.2 million monthly uniques, on top of a 4.1 million monthly print reach, making a total reach of 15.2 million.

That comes from a near-13% growth in paid digital subscribers in the year to April 2022, but also expansion across several online touchpoints.

The title’s new ABC1 25-44 audience, which consumes The Times in print, digital or Times Radio plus at least one of the newer platforms, says the quality and relatable nature of Times content leaves them feeling inspired, informed, fascinated, happy and optimistic.

Emotive contexts are proven to have a positive effect on the advertising within it and this is true for the new Times audience, too.

Times print and Times Radio were more likely to leave audiences feeling fascinated and its audio and digital platforms were more likely to leave audiences feeling optimistic.

Regardless, these five sets of emotions are strong emotions for engagement. That is important for a clear reason - the emotional context in which brands advertise makes a huge difference to advertising recall and action.

Methodology

Work was carried out by independent research agency called Differentology along with News UK senior commercial insights manager Emma Pipe. The research was run in two stages; the first stage was exploratory to uncover the trends and traits and the second stage was an evaluation to ensure robustness of findings.

The audience profile recruited is ABC1 25-44 year olds who are all new to The Times brand in the last 2 years. They are readers or listeners of Times Print, Times Digital or Times Radio and they all engage with at least one of our new platforms, defined as; Times Money Mentor, Times on Apple News + or our Times audio platforms.

Stage One: Was an exploration stage - a 3 day online community with 22 respondents, plus 5 in depth video interviews. This was a deep dive into their personality and values to understand; their motivations, their relationship with brands and the emotional context in which the Times brand reaches them.

Stage Two: Was the evaluation stage to quantify our findings - this consisted of a 15 minute online survey with 529 respondents.

Photo credit: Photo by Joshua Rawson-Harris: Picture taken for CouponSnake – https://couponsnake.com/ - https://unsplash.com/photos/YNaSz-E7Qss - Used under Unsplash License.

News UK

News UK