The RAJAR Q4 2022 fieldwork period included an eventful quarter - with Liz Truss being appointed Prime Minister, consequently resigning, Rishi Sunak being appointed, as well as our first winter World Cup.

Overall radio listening was up QoQ, with just under 90% of the UK population listening weekly.

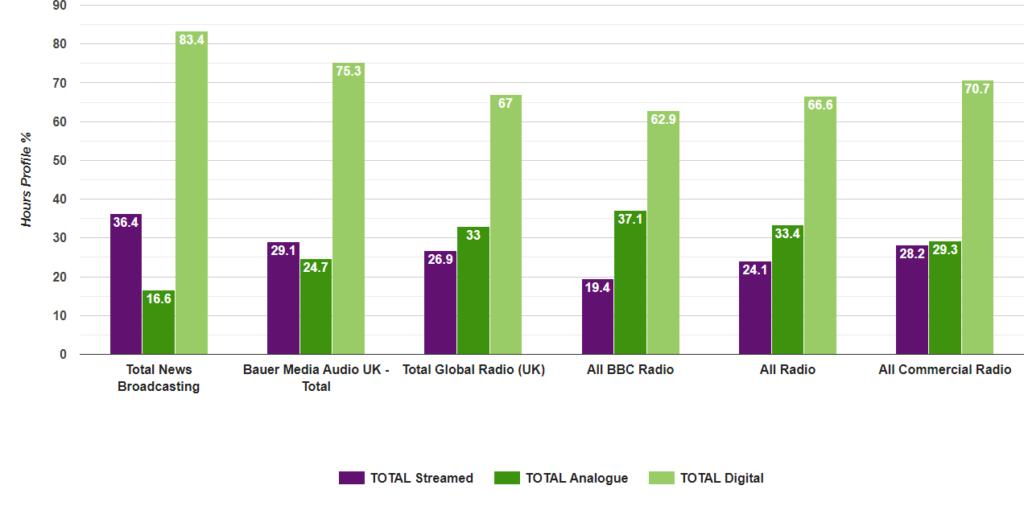

In terms of platforms, digital listening now makes up over two thirds of weekly listening, driven by internet and smart speaker listening, with DAB interestingly now in slight decline.

Radio reboot

DAB is still classified by RAJAR as "digital" listening, but it's no longer contributing to the industry's digital growth narrative, due to declining DAB listening in the home.

Smart speaker listening continues to grow, now accounting for 14% of total hours across radio, driven by the accessibility of smart devices and increased signposting from stations on how to listen across multiple devices.

News Broadcasting remains the UK's most digital radio broadcaster, with 83% of hours digitally based and 36% streamed (internet + smart speaker) - comfortably ahead of the competition.

We have more than twice as much streaming listening as we have analogue listening.

This naturally has a number of commercial and programming benefits associated with a more comprehensive understanding of our audiences.

Location, location, locoation

With regards to listening location, the RAJARs show in-home listening is declining and in-car listening increasing, reflecting shifting commuting and working patterns.

Across our stations, we are well placed to benefit from location-based listening.

talkSPORT naturally has one of the highest in-car listening figures in the market (36%) and Times Radio in-home (77%).

Commercial growth

When we look at commercial and non commercial radio listening, it was once again a tough quarter for the BBC, with a number of notable declines across key BBC stations, together with presenter changes.

Overall, commercial radio continues to take a higher share of all listening.

Across our stations:

- talkSPORT saw reach up 10% quarter-on-quarter, with the network reaching over 3M listeners, in what was a positive period for the network, including the Autumn Nations Rugby and 330 hours of live coverage from the FIFA World Cup in Qatar.

- Virgin Radio UK network now reaches just under 2M listeners, with 11m weekly listening hours, up 5% quarter-on-quarter.

- TalkRadio delivered another strong performance, with reach at 608k listeners, and listening hours up 4.7M hours each week, up 7% quarter-on-quarter.

- Times Radio saw reach increase 4% QoQ to 563k and weekly listening hours up 7% QoQ to 3.4M. 79% of Times Radio’s audience are now in the hard-to-reach ABC1 category, a record for the station and the highest in market.

In summary, it was a positive set of numbers across the industry and our stations, highlighting the strength of audio as a medium, as well as our output.

From a commercial point of view, audio is becoming even more relevant for tactical campaigns, due to its targeting efficiencies and cost-effective reach.

Clients and agencies are increasingly keen to explore interactive and voice-activated ads via smart speakers, providing higher engagement and attention, with our network well placed to take advantage of this.

News UK

News UK