RAJAR's quarterly results are always key dates in the diary for those working in the audio industry, and the wider media market.

Depending on the results, stations and presenters typically either ignore them and point to gaps in the methodology, or make live on-air references thanking their listeners for an improved set of figures!

Now the dust has settled on RAJAR'S Q4 2021 results, published in February 2022, we’ve picked out some trends and highlights below.

Changing habits

Commercial radio is performing well, with people listening to commercial stations longer. The BBC continues to struggle, with fewer people listening to BBC stations, for less time - driven by Radio 1, Radio 3 and Radio 4 performance.

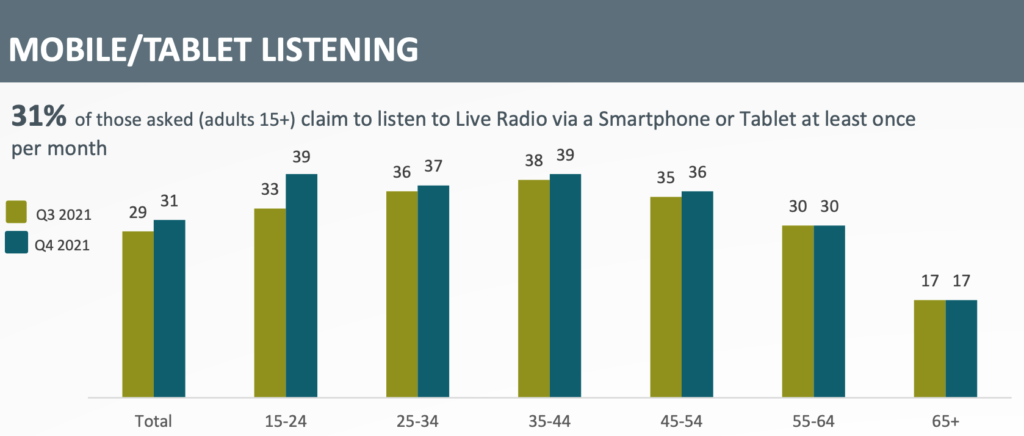

As anticipated, digital listening is on the rise, with just under two thirds of all radio listening via some kind of digital platform, whilst just 36% is through traditional AM/FM listening.

It's not only the 15-24s driving this trend either - 67% of under 44s listen digitally.

Wireless Group is well-placed to capitalise on the digital trend, with 87% of all listening hours digitally-based - significantly higher than Global, Bauer and BBC stations, allowing it to target more effectively from a commercial perspective, unlock revenue opportunities and tailor the listening experience to listeners.

Time is shifting

In terms of listening behaviour and peaks of listening, we have seen changes driven by the pandemic. Listening at home has remained high, with the breakfast peak shifting later to 9am.

This pattern is reflected across Wireless' own stations, with internal connected listening data pointing towards peaks within mid morning across our speech stations.

RAJAR also released its latest MIDAS report, which is a separate survey to RAJAR, looking at the wider market.

This survey highlights the continued growth in podcasts, as well as the increased listening of on demand music (ie streaming services such as Spotify) which is now up to 35%.

This will potentially be of concern for some music stations, as well as highlighting the importance of presenters to help give stations identity and personality to improve loyalty.

Another interesting fact in this report is that 94% of podcast listening is alone, whereas for radio this is only 54%, highlighting differences in contextual listening and surfacing new advertising opportunities.

News UK

News UK